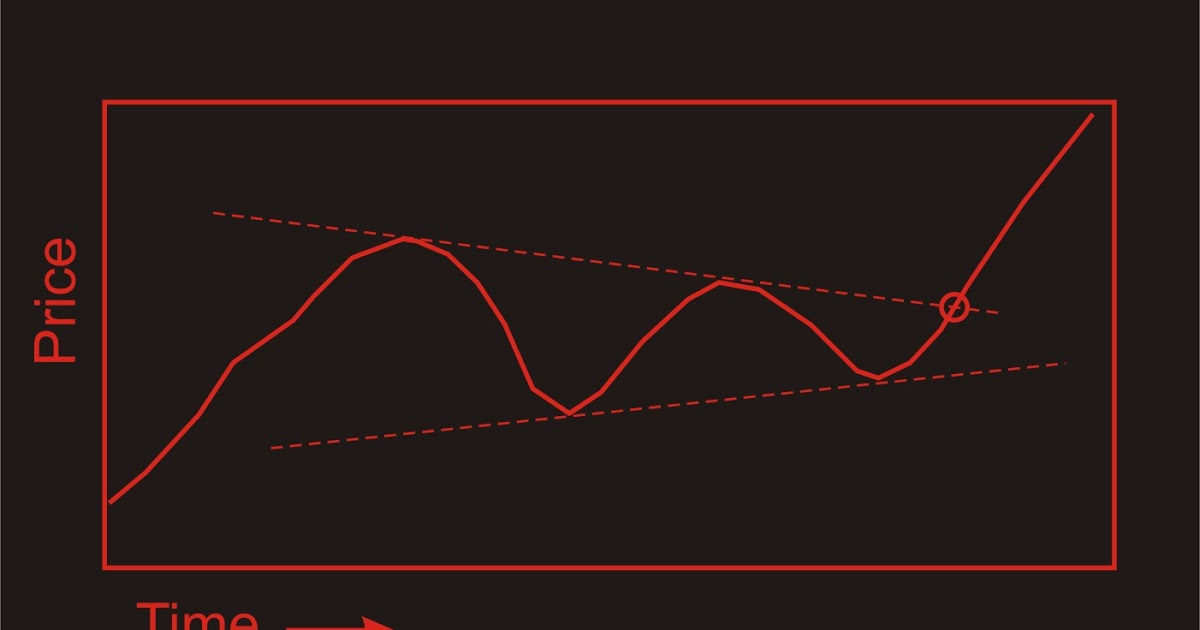

The 20 Most Useful Stock Chart Patterns: Ascending Triangles That’s why we’ve put together this simple list of the most helpful stock chart patterns used today. While it’s hard to overestimate the value of stock chart patterns, they can be difficult to spot for the untrained eye. And options traders can lean on this information to make short-term profits. Momentum investors can use it to figure out when the price is heading upward. Short sellers can use patterns to predict when an asset is about to drop in value. This can be incredibly handy information to have for investors of any kind. So when investor’s see them forming, they can get a better idea of which direction a stock’s price may be heading. Stock chart patterns tend to repeat themselves over and over again. Or they can offer a long-term view of a stock’s performance over the course of several years. They can be a micro-analysis of a single day’s worth of trading. This is why they are used by the likes of retail investors, billion-dollar hedge funds and everyone in between.īasically, stock chart patterns are a way to view the ups and downs of a stock’s price over the course of time… and then use that information to help predict future movement. This can give a major leg up against the competition. They provide an exceptionally detailed level of a stock’s trend lines. Rising Wedges that are large will give better performance than narrow wedges.Stock chart patterns can be a vital tool for investors. Pullbacks will be harmful to the performance of the pattern.Ī break point is normally located around 60% of the length of the rising wedge. The risk of running a false bearish break out is quite low.Īn upward retracement is normally two times faster than the formation of the wedge. The more that the trend lines are sloped, the more the downward movement will be violent.įalse bearish breakouts provide an indication on the side of the exit because in only 3% of cases, when a bearish breakout occurs, the price will go out of the wedge by the top.

Note the spacing between each contact point the lines must be important otherwise it could be a pennant. – In 53% of cases, a pullback arises on the resistance – In 63% of cases, the goal of the pattern is reached once the support is broken – In 55% of cases, the rising wedge shows a reversal pattern – In 82% of cases, there will be a downward exit. Take a look at some statistics about the rising wedge: The target price is given by the lowest point that resulted in the formation of the wedge. This movement then has almost no buying power which will indicate the willingness of a bearish reversal. Volumes will then be at their lowest and constantly decrease as the waves. Another wave will be formed thereafter but prices will increase less and less at the contact with the support. The second wave of increase will then occur, however with lower amplitude, which may appear the weakness of buyers. The lowest will be reached during the first correction on the resistance of the wedge and will form the support. This one is identified by a continuous reduction of the amplitude of the waves. The pattern indicates the shortness of buyers. These lines must be touched at least twice for validation. To validate rising wedge there must be oscillation between the two lines. A bearish reversal pattern formed by two assembled upward slants is called a rising wedge.

0 kommentar(er)

0 kommentar(er)